Trendlines are one of the simplest tools in technical analysis — and also one of the most misused.

Trendlines are one of the simplest tools in technical analysis — and also one of the most misused.

Many traders draw them inconsistently, trade them emotionally, or abandon them after a few losing trades. The problem is not trendlines themselves, but how they are drawn, interpreted, and traded.

If you clicked on this article, chances are you want to understand how to trade using trendlines correctly, avoid common mistakes, and apply them with confidence in real market conditions.

This guide focuses on how to trade using trendlines in a structured, rule-based way that removes guesswork and emotional decisions.

By the end of this guide, you’ll know:

- What trendlines really represent (beyond “connecting dots”)

- How to draw reliable trendlines across multiple timeframes

- When to trade trendline bounces vs breakouts — and when to avoid both

- Clear entry, stop-loss, and take-profit logic

- How to combine trendlines with price action, structure, and indicators

Table of Contents

TL;DR

- Trendlines visualize direction and rate of change, not prediction

- More touches increase visibility, not guaranteed reliability

- Bounces work best in established trends; breakouts require acceptance

- Always treat trendlines as zones, not exact prices

- Risk management matters more than perfect trendline entries

1. What Is a Trendline?

A line indicating the general course or tendency of something.

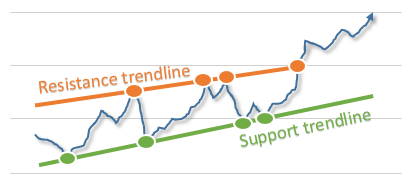

In trading, a trendline is a diagonal support or resistance zone created by connecting a sequence of higher lows in an uptrend or lower highs in a downtrend.

- A trendline connecting swing highs acts as dynamic resistance.

- A trendline connecting swing lows acts as dynamic support.

Trendlines are not fixed levels. They evolve over time and should always be interpreted as areas of interest, not exact prices.

Example of support and resistance trendlines

Trendlines are widely used in technical analysis and are documented in classic trading literature and references such as Investopedia’s trendline definition.

2. Why Trendlines Matter in Trading

Trendlines do more than show direction. They help traders:

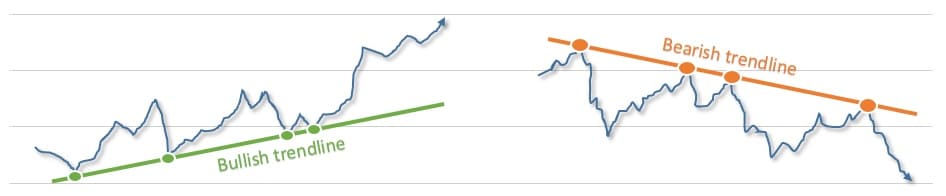

- Define directional bias (bullish vs bearish)

- Time entries and exits within market structure

- Visualize the market’s rate of change

- Spot potential shifts in trend or exhaustion

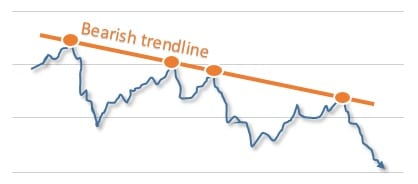

Bullish and bearish trendlines

2.1 Trendline Slope and Rate of Change

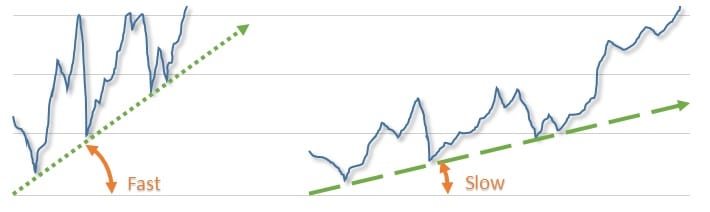

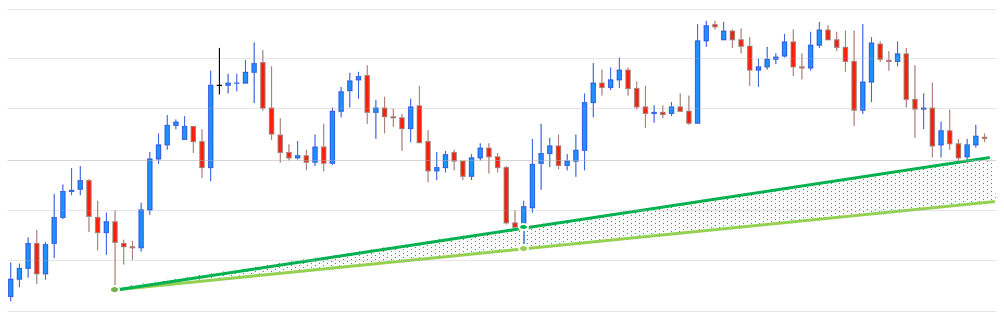

The slope of a trendline reflects the speed at which price moves relative to time, not momentum alone.

Very steep trendlines often signal aggressive moves that are unsustainable and prone to sharp corrections. Shallow, steady slopes tend to be more durable and tradable.

Trendline slope showing different rates of price change

3. How to Draw Trendlines Correctly

3.1 Core Rules

- A trendline must connect at least two clear swing points.

- Three or more touches increase visibility, not certainty.

- Use the same reference consistently (wicks or closes).

More touches mean more traders see the line — but late-stage trendlines often fail as liquidity builds for a breakout.

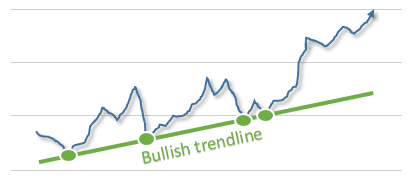

3.2 Uptrend Trendlines

Draw the trendline along higher lows.

Price forming higher lows

3.3 Downtrend Trendlines

Draw the trendline along lower highs.

Price forming lower highs

3.4 Trendlines Are Zones, Not Exact Prices

A common beginner mistake is treating trendlines as precise levels. In reality, price often:

- Overshoots slightly

- Reverses before touching

- Breaks briefly and then respects the zone again

Because time moves forward, the exact price of a trendline constantly changes. Precision entries are unrealistic — zones matter more than lines.

Trendlines drawn using closes vs wicks

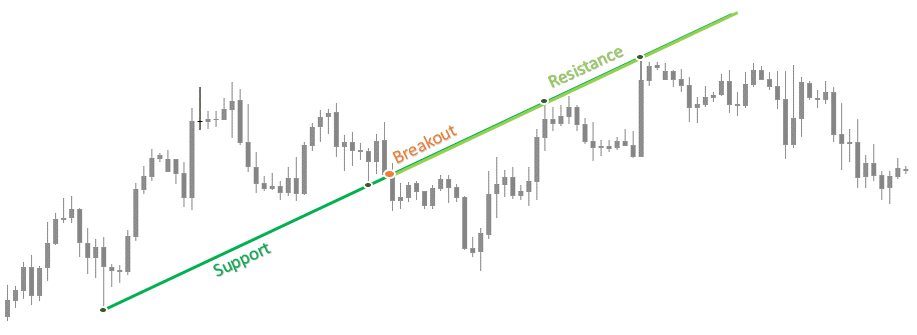

3.5 Support–Resistance Flip (Critical Concept)

When a trendline breaks decisively, it may later act as support or resistance from the opposite side. This behavior often confirms its importance, especially when aligned with higher-timeframe structure.

Support turning into resistance

4. How to Trade Using Trendlines

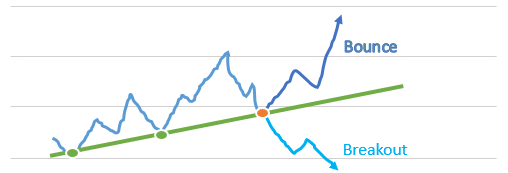

Every trendline trade boils down to one question:

Will price bounce or break?

This decision must always be made in context — trend strength, volatility, nearby structure, and higher-timeframe bias matter more than the trendline itself.

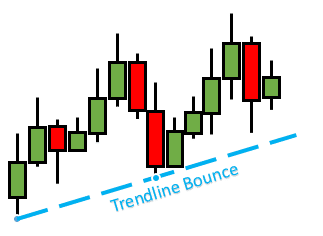

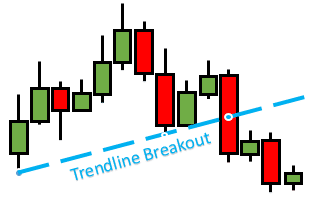

Bounce vs breakout scenarios

If you are serious about learning how to trade using trendlines, you must decide in advance whether you are trading bounces, breakouts, or standing aside.

4.1 Trendline Bounce vs Breakout

| Strategy | Best Market | Risk Profile | Confirmation |

|---|---|---|---|

| Bounce | Established trend | Lower | Price reaction / candle behavior |

| Breakout | Compression / exhaustion | Higher | Acceptance beyond the trendline |

4.2 How to Trade a Trendline Bounce

Bounce Rules (practical template)

Entry: Near the trendline using a volatility-adjusted distance (≈ 0.1–0.3 ATR)

Stop-loss: Beyond the trendline plus buffer (≈ 0.2–0.5 ATR)

Take-profit: Prior swing or minimum 1:2 risk-to-reward

Trendline bounce example

4.3 How to Trade a Trendline Breakout

A breakout is valid only when price accepts beyond the trendline.

Signs of acceptance include:

- Strong close beyond the trendline

- Expansion in range or momentum

- Structure shift or successful retest

In spot FX, confirmation comes from price behavior and structure, not volume alone.

Trendline breakout example

5. Common Trendline Mistakes

- Forcing trendlines to fit a bias

- Constantly redrawing lines (curve-fitting)

- Trading every touch without confirmation

- Ignoring higher-timeframe structure

6. Best Practices

- Draw trendlines on higher timeframes first

- Align with market structure and moving averages

- Wait for reaction, not prediction

- Risk no more than 1–2% per trade

- Journal every trendline trade

If you combine trendlines with proper risk control, tools like the Equity Tracker MT5 can help you monitor drawdown in real time.

You may also want to read our guide on price action trading tools to complement trendline analysis.

7. Frequently Asked Questions

7.1 How many touches make a trendline valid?

Two define it. Three or more increase visibility, not certainty.

7.2 What angle is too steep?

If price accelerates rapidly, expect instability or correction.

7.3 Do trendlines work on all timeframes?

Yes — but higher-timeframe trendlines always dominate lower ones.

8. Conclusion

Trendlines are not magical tools. They don’t predict the future — they organize price behavior.

When used consistently, in context, and combined with solid risk management, they become one of the most effective ways to trade market structure.

Master the process, not the line.