When it comes to technical analysis, few tools are as popular (or as misunderstood) as moving averages and trend lines.

Both help traders identify trend direction, find entries/exits, and avoid fighting the market. But they behave differently, work best in different conditions, and suit different trading styles.

In this guide, you’ll learn moving averages vs trend lines with clear examples, a quick comparison table, and the 7 key differences you can apply immediately.

Table of Contents

- 1. What Are Moving Averages?

- 2. How to Use Moving Averages in Trading

- 3. What Are Trend Lines?

- 4. How to Use Trend Lines in Trading

- 5. Moving Averages vs Trend Lines: 7 Key Differences

- 6. Quick Comparison Table

- 7. Which Should You Use?

- 8. FAQs

- 9. Appendix: Code Examples (MT4/MQL4)

- 10. Conclusion

1. What Are Moving Averages?

A moving average (MA) is a chart tool that smooths price fluctuations so you can see the underlying direction more clearly. Think of it as a noise filter: it reduces random spikes and makes trends easier to spot.

Moving averages are calculated from historical price data. That makes them objective (same settings → same line), and easy to test and automate.

Types of Moving Averages (SMA, EMA, WMA)

Not all moving averages behave the same. The most common types are:

- SMA (Simple Moving Average): each price in the period has equal weight.

- EMA (Exponential Moving Average): gives more weight to recent prices (reacts faster).

- WMA (Weighted Moving Average): also weights recent prices more, but differently than an EMA.

How Moving Averages Work

A 20-period MA continuously averages the last 20 bars (on whatever timeframe you’re viewing). You can calculate it using the close, open, median, high/low, etc. depending on your platform and preference.

The key tradeoff is simple:

- Smoother MA (longer period) → clearer trend view, but more lag.

- Faster MA (shorter period / EMA) → quicker signals, but more noise.

2. How to Use Moving Averages in Trading

Moving averages are best used for trend definition and signal confirmation. They adapt automatically to price, which is why they’re popular in discretionary and algorithmic trading alike.

The 200-Period MA Strategy

A classic approach is using the 200-period moving average as a “market regime” filter:

- Price above the 200 MA → bias toward buys (look for long setups).

- Price below the 200 MA → bias toward sells (look for short setups).

This is simple, repeatable, and works particularly well on higher timeframes where noise is lower.

Moving Average Crossover Signals

Another common use is a crossover system, typically with a faster MA (e.g., 20) and a slower MA (e.g., 50):

- Bullish crossover: fast MA crosses above slow MA → potential buy signal.

- Bearish crossover: fast MA crosses below slow MA → potential sell signal.

Practical tip: Many traders improve crossovers by adding multi-timeframe confirmation. If you like that style of trading, an indicator such as MTF Triple Moving Averages can help you quickly check whether multiple timeframes agree (useful as a filter rather than a “magic signal generator.”)

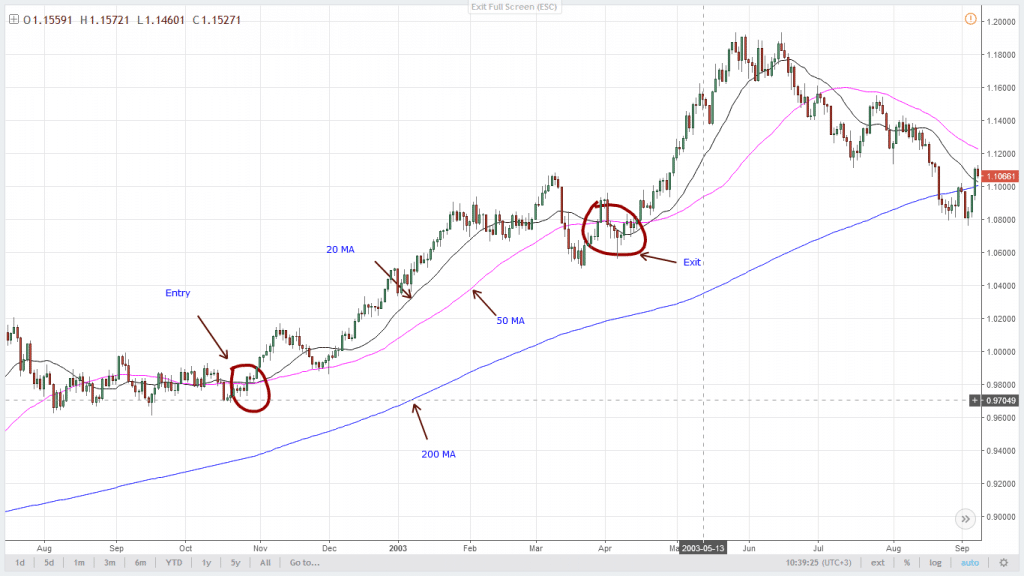

Below are examples showing how MA signals can look in trending markets, and why ranging markets can be challenging.

Moving Averages vs Trend Lines – Simple Moving Averages example – Buy Entry and Exit

Moving Averages vs Trend Lines – Simple Moving Averages example – Buy Entry and ExitBuy example (typical rules):

- Define the overall trend using price relative to the 200 MA.

- In an uptrend, look for a 20/50 crossover as confirmation.

- Place the stop below a recent swing low; exit when momentum fades (e.g., crossover back down).

Sell example (typical rules):

- Define the overall trend using price relative to the 200 MA.

- In a downtrend, look for a 20/50 crossover as confirmation.

- Place the stop above a recent swing high; exit when momentum fades (e.g., crossover back up).

Notice the weakness: in ranges, moving averages can whip back and forth and generate low-quality signals. This is one reason traders often combine MAs with trend lines for better context and more precise levels.

3. What Are Trend Lines?

A trend line is a diagonal line drawn on the chart to represent market structure, typically connecting swing lows (support) in an uptrend or swing highs (resistance) in a downtrend.

Trend lines are powerful because they map how traders visually interpret supply/demand. The tradeoff is that trend lines are subjective: different traders may draw them slightly differently.

How to Draw Trend Lines Correctly

To keep your trend lines useful (and not random), follow these rules:

- Use at least 3 touches (two points create a line; the third point validates it).

- Connect clear swing points, not “messy” noise.

- Be consistent: use the same method (wicks vs closes) to avoid bias.

Trend Line Slope and Significance

Slope matters. A very steep trend line can break easily (it may represent momentum rather than a stable trend). A flatter trend line often lasts longer and behaves more like a durable support/resistance zone.

4. How to Use Trend Lines in Trading

Trend lines are commonly used in two high-probability ways: as dynamic support/resistance and as breakout structure.

Trend Lines as Support/Resistance

In an uptrend, connect swing lows to form a support trend line. Traders often look for bounces from that line as entry opportunities (especially when the higher-timeframe trend is still intact).

In a downtrend, connect swing highs to form a resistance trend line. Traders often look for rebounds from that line as sell opportunities.

Trading Trend Line Breakouts

Trend line breakouts can be profitable when they happen after consolidation, because the market has “stored energy” and a break can trigger momentum.

Risk note: Both tools can generate false signals. That’s why risk management matters. And because floating drawdown is often invisible if you only watch balance, monitoring equity in real time can add discipline, tools like Equity Tracker MT5 are designed to make that part easier (especially during trending phases and breakout volatility) without changing your strategy.

5. Moving Averages vs Trend Lines: 7 Key Differences

This is the core of the topic. If you remember only one section, make it this one.

- Objectivity vs Subjectivity

Moving averages are fully objective and rule-based, meaning the same settings will always produce the same output. Trend lines are subjective and depend on how each trader interprets swing highs and lows. - Automation Capability

Moving averages are easy to automate and widely used in algorithmic trading systems. Trend lines are difficult to automate reliably because their placement depends on human judgment. - Reaction Speed

Moving averages lag price because they’re calculated from past data. Trend lines can feel more responsive because they reference structure, but they still depend on past swings and your swing definition. - Best Market Conditions

Moving averages perform best in strong trends but often fail during consolidation. Trend lines can help in trends and some ranges (channels). In flat ranges, horizontals often work better. - Primary Use Case

Moving averages are mainly used for trend identification and signal confirmation. Trend lines are often better for precise entries, exits, and breakout validation. - Flexibility

Moving averages require predefined settings (period, type, price input). Trend lines are flexible and can adapt dynamically to evolving market structure. - Learning Curve

Moving averages are easier for beginners to apply consistently. Trend lines require more screen time, experience, and discretion to use well.

6. Quick Comparison Table

| Feature | Moving Averages | Trend Lines | Winner |

|---|---|---|---|

| Objectivity | Fully objective (formula-based) | Subjective (trader interpretation) | 🏆 MAs |

| Automation | Easy to code and backtest | Difficult to automate reliably | 🏆 MAs |

| Reaction Speed | Lagging (based on past data) | Real-time (drawn on current structure) | 🏆 TLs |

| Best Market | Strong trends | Trends + ranges | 🏆 TLs |

| Learning Curve | Beginner-friendly | Requires practice | 🏆 MAs |

| Precision | General signals | Precise levels | 🏆 TLs |

| Customization | Period, type, price input | Unlimited flexibility | 🏆 TLs |

7. Which Should You Use?

The best choice depends on your trading style, your experience level, and whether you want to automate your approach.

Best for Beginners

Moving averages are typically better for beginners because they’re objective and consistent. You can follow simple rules (like the 200 MA bias) and avoid overthinking.

Best for Algorithmic Trading

Moving averages win again here. They’re easy to define, code, backtest, and optimize. Trend lines can be approximated in code, but it’s harder to do reliably across instruments and market regimes.

Combining Both Tools

This is where many experienced traders end up:

- Use moving averages to define trend direction and avoid trading against the market.

- Use trend lines to plan precise entries/exits and validate breakouts.

And regardless of which tool you prefer, risk management should stay objective. If you’re trading MT5 and want a clearer view of floating risk, tracking equity changes (not just balance) can help you stick to your rules (especially during trend pullbacks and breakout volatility).

8. FAQs

Are moving averages better than trend lines?

Neither is “better” universally. Moving averages are objective and great for trend direction. Trend lines offer flexibility and precision for levels, entries, and breakouts.

Can I use moving averages and trend lines together?

Yes. A common approach is: moving averages for trend bias, trend lines for timing and structure.

Which is better for automated trading?

Moving averages. They are rule-based and straightforward to backtest. Trend lines are harder to automate because drawing them is subjective.

What timeframes work best for moving averages?

Moving averages tend to be more reliable on higher timeframes (H4, Daily, Weekly) where noise is lower. On lower timeframes, consider using them mainly as a filter.

How many touches validate a trend line?

Two points create a line, but three touches (or more) typically make it meaningful (because the market has “respected” it multiple times).

Do trend lines work in ranging markets?

Often, yes because they can behave like dynamic support/resistance. That said, in tight ranges, horizontal levels may be clearer than diagonal lines.

Why do moving averages fail in consolidation?

Because they lag price and tend to whip around when price lacks direction, creating frequent crossovers with low edge.

9. Appendix: Code Examples (MT4/MQL4)

If you’re coding on MetaTrader 4, here are two simple examples: a manual SMA calculation and the built-in iMA version.

//+------------------------------------------------------------------+

double CalcSimpleMovingAverage(string symbol,int period,ENUM_TIMEFRAMES timeframe)

{

double total=0;

double prices[];

ArrayCopySeries(prices,MODE_CLOSE,symbol,timeframe);

for(int i=0;i<period;i++)

total+=prices[i];

return total/period;

}

//+------------------------------------------------------------------+

Using the built-in MT4 function:

double sma = iMA(Symbol(), PERIOD_CURRENT, 20, 0, MODE_SMA, PRICE_CLOSE, 0);

10. Conclusion

Moving averages and trend lines are two of the most useful tools in technical analysis (but they solve different problems).

- Moving averages help you define trend direction objectively and build repeatable rules.

- Trend lines help you understand structure and trade with more precision around key levels.

If you want the most practical approach, combine both: use moving averages for trend bias and trend lines for entries, exits, and breakout validation, always backed by solid risk management.