If you’ve ever installed MetaTrader 4 and immediately searched for the best MT4 indicators, you’re not alone. The right indicators help you spot trends, define key levels, understand session behavior, and avoid trading blind. The wrong ones clutter your chart and give you false confidence.

In this guide, you’ll get a clean, practical shortlist of 10 MT4 indicators I actually consider useful, plus: a quick comparison table, clear download buttons, and a simple step-by-step installation walkthrough.

About the author: Carlos Oliveira — I build trading tools for MetaTrader and run ForexTradingTools.eu. I focus on practical utilities and indicators that improve decision-making, chart clarity, and risk awareness.

Table of Contents

1. Quick Summary: What You’ll Learn

- Which best MT4 indicators are actually useful (and why)

- A quick comparison of all 10 indicators (purpose + best timeframe)

- How to install MT4 indicators the right way

- Simple combinations that reduce noise and improve confirmation

2. Comparison Table: Best MT4 Indicators at a Glance

| # | Indicator | Best For | Best Timeframes | Type |

|---|---|---|---|---|

| 1 | Key PA Levels | Psychological S/R & round numbers | All (especially H1–D1) | Price Action |

| 2 | Session High Low | Session ranges, overlap & intraday levels | M5–H1 | Session |

| 3 | Support & Resistance Price Zones | Automated S/R zones (fractals) | M15–H4 | Support/Resistance |

| 4 | Equity and Balance | Monitor account equity curve & recent trades | N/A (account-level) | Risk/Performance |

| 5 | MTF Bollinger Bands | Higher-timeframe BB confirmation | M5–H1 (with HTF overlays) | Volatility/Trend |

| 6 | Daily Profit Loss | Daily/weekly/monthly performance snapshot | N/A (account-level) | Risk/Performance |

| 7 | Daily Data | Daily range context + distance to day high/low | M5–M30 | Intraday Context |

| 8 | CalendarFX | News schedule + chart markers | M1–H1 | Fundamental Filter |

| 9 | Strategy Checklist | Stay disciplined & follow your rules | Any | Process/Execution |

| 10 | Zig Zag Value | Swing structure for Fibonacci tools | M15–H4 | Structure |

Tip: Don’t use all 10 at once. Start with 2–3 that match your trading style, then add only if it improves clarity.

3. The 10 Best MT4 Indicators (with Downloads)

3.1) Key PA Levels (Key Price Action Levels)

What it does: Draws clean horizontal levels based on psychological price action zones (especially round numbers), helping you see natural support and resistance quickly.

- Best for: Support/resistance, targets, stop placement, “big figure” levels (e.g., 1.1000)

- Best timeframes: All (I like it for H1–D1 analysis)

- Why it helps: Humans cluster orders around clean numbers—so these levels often matter.

Expert tip: Use these levels to define trade “zones,” then wait for your entry trigger (candle pattern, breakout, retest, etc.). Levels alone are not an entry.

3.2) Session High Low

What it does: Shows when major trading sessions start/end and plots each session’s high/low levels—plus overlap windows. Extremely useful for intraday traders.

- Best for: Intraday structure, breakouts, session range plays

- Best timeframes: M5–H1

- Note: Great for spotting when volatility is likely to pick up (session opens + overlaps).

Expert tip: If you trade London or NY, treat session high/low like “intraday key levels.” Combine with a PA trigger instead of guessing.

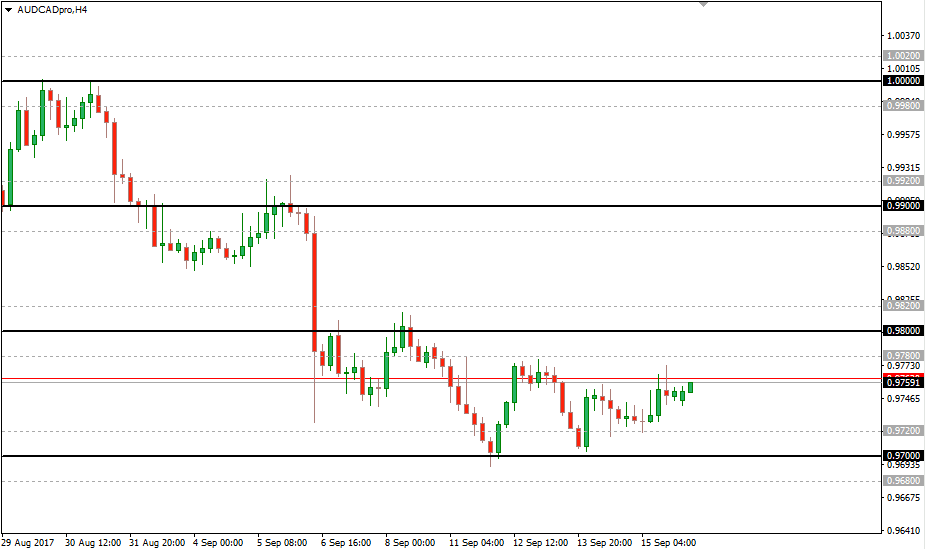

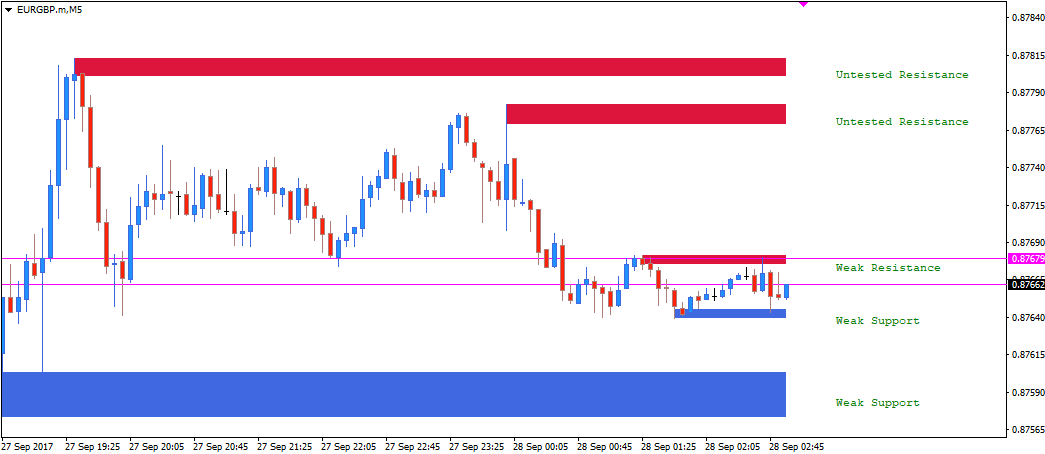

3.3) Support & Resistance Price Zones

What it does: Automatically finds support and resistance zones using fractals, then labels zones by strength/validation (e.g., tested vs untested). Great if you’re still building confidence drawing levels manually.

- Best for: Identifying key zones, planning entries/exits, risk placement

- Best timeframes: M15–H4

- Why it helps: Turns messy “guesswork” into consistent zones you can review quickly.

Expert tip: Treat zones as areas, not single lines. Combine with a session level (#3.2) or a round number level (#3.1) for higher-quality confluence.

3.4) Equity and Balance

What it does: Displays equity/balance performance in a clearer way and helps you quickly see how trading (manual or automated) is behaving over time—especially useful during live tests.

- Best for: Monitoring performance, spotting drawdowns earlier, sanity-checking robots

- Best timeframes: Not chart-timeframe dependent (account-level view)

- Why it helps: Balance can look “fine” while equity is quietly bleeding.

Expert tip: If you run EAs, set a maximum acceptable equity drawdown and respect it. Most blow-ups happen because traders ignore equity until it’s too late.

3.5) MTF Bollinger Bands (Multi-Timeframe)

What it does: Displays Bollinger Bands from higher timeframes on the same chart. This helps you trade lower timeframes while staying aligned with higher-timeframe volatility and mean-reversion context.

- Best for: Confluence, volatility context, HTF confirmation

- Best timeframes: Trade M5–H1 with H1–D1 bands layered

- Why it helps: Lower timeframe signals are stronger when they agree with higher timeframe structure.

Expert tip: If price is stretched at the HTF outer band, be cautious with trend-chasing entries on lower timeframes.

3.6) Daily Profit Loss

What it does: Shows performance as a compact table (points, money, % change) across different time windows. It’s a clean “dashboard” view of results without opening separate reports.

- Best for: Daily discipline, tracking progress, preventing “revenge trading”

- Best timeframes: Not chart-timeframe dependent (account-level)

- Why it helps: Keeps you aware of performance in real-time.

Expert tip: Set a daily max loss rule. When it hits, stop. A “small red day” protects you from a catastrophic day.

3.7) Daily Data

What it does: Adds daily context to intraday charts: a box over the current day’s candles, a daily candle on the side, and useful stats like range and distance to the day’s high/low.

- Best for: Intraday context, daily range awareness, avoiding late entries

- Best timeframes: M5–M30

- Why it helps: Many bad trades happen after most of the day’s range is already “spent.”

Expert tip: Combine this with Session High/Low. If price is already near the day’s extreme, be selective with breakout trades.

3.8) CalendarFX

What it does: A clean news calendar indicator that can show upcoming events in a simple table and optionally mark them on your chart (flags/lines). Ideal if you want a quick “news filter.”

- Best for: Avoiding trades right before high-impact news, planning session risk

- Best timeframes: M1–H1

- Why it helps: Spreads widen and volatility spikes can invalidate technical setups.

Expert tip: If you’re new, avoid trading 5–15 minutes before major releases (CPI, NFP, rate decisions) unless news trading is your strategy.

3.9) Strategy Checklist

What it does: Keeps a simple checklist visible on your chart so you follow your rules consistently. This is not a “signal” tool—it’s a discipline tool (often more valuable than another indicator).

- Best for: Preventing impulse trades, staying consistent, building good habits

- Best timeframes: Any

- Why it helps: Most traders don’t fail from lack of indicators—they fail from breaking rules.

Expert tip: Add “Is risk defined?” and “Is this trade within my plan?” If you can’t answer in 10 seconds, it’s probably a skip.

3.10) Zig Zag Value

What it does: Filters small price movements to highlight clearer swing highs/lows. Especially useful if you use Fibonacci retracements/projections and want cleaner swing structure.

- Best for: Swing structure, Fibonacci tools, simplifying market noise

- Best timeframes: M15–H4

- Why it helps: Cleaner swings = cleaner fib anchors (less random guessing).

Expert tip: ZigZag repaints while forming swings. Use it for structure and analysis, not as a standalone entry signal.

4. How to Install Indicators in MT4 (Step-by-Step)

Most “indicator doesn’t work” problems come from installing it in the wrong folder. Here’s the simplest correct method:

- Download the file (MQ4 or EX4) using the button in the indicator section above.

- In MT4, go to File → Open Data Folder.

- Open MQL4 → Indicators.

- Copy the MQ4/EX4 file into that Indicators folder.

- Restart MT4 (or right-click Navigator → Indicators → Refresh).

- Drag the indicator onto your chart and adjust inputs if needed.

Troubleshooting: If the indicator still doesn’t appear, confirm it’s in Data Folder → MQL4 → Indicators (not the Program Files folder), and check the Experts / Journal tabs for errors.

5. How to Combine MT4 Indicators (Without Clutter)

The goal isn’t “more indicators.” The goal is clear confirmation. These combos work because each tool has a different job:

5.1) Combo A: Clean Support/Resistance + Intraday Timing

- Key PA Levels (3.1) → big psychological levels

- Session High Low (3.2) → session range + overlap windows

- Daily Data (3.7) → daily range context

5.2) Combo B: “Am I trading into a wall?” (Confluence Check)

- Support & Resistance Price Zones (3.3) → automated zones

- MTF Bollinger Bands (3.5) → HTF volatility boundaries

5.3) Combo C: Performance + Discipline (Underrated Edge)

- Equity and Balance (3.4) → equity awareness

- Daily Profit Loss (3.6) → keep daily behavior in check

- Strategy Checklist (3.9) → prevents impulse trades

Rule of thumb: Use 1 indicator per “job”:

- Levels (S/R, round numbers)

- Timing (sessions, daily context)

- Filter (news, HTF confirmation)

- Discipline (checklist, performance tracking)

6. FAQs About the Best MT4 Indicators

6.1) What is MT4?

MT4 (MetaTrader 4) is a widely used trading platform for Forex and CFDs that supports custom indicators, scripts, and expert advisors (EAs).

6.2) Can these indicators guarantee trading success?

No. Indicators help you visualize information and improve decision-making, but they don’t replace risk management, execution discipline, and a proven trading plan.

6.3) Do I need to use all 10 indicators?

No. Start with 2–3 that solve your biggest problems (levels, timing, discipline). Add more only if it improves clarity—never just to “feel confident.”

6.4) Which are the best MT4 indicators for beginners?

For most beginners: Key PA Levels (3.1), Support & Resistance Price Zones (3.3), and Strategy Checklist (3.9). They build structure and discipline without turning your chart into noise.

6.5) Which indicators are best for intraday trading?

Session High Low (3.2) + Daily Data (3.7) are excellent for intraday context. Add CalendarFX (3.8) if you want a simple news filter.

6.6) Why do some indicators “repaint”?

Some indicators (like ZigZag) update historical points as new price data arrives. That’s not always “bad,” but it means you should avoid using them as standalone entry signals.

6.7) How do I know if an indicator is installed correctly?

If it appears in Navigator → Indicators, it’s installed. If it doesn’t show up, re-check the folder path (Data Folder → MQL4 → Indicators) and restart MT4.

7. Conclusion: Use Indicators as Tools, Not Crutches

The best MT4 indicators don’t “predict the market.” They help you see what matters faster: key levels, session behavior, daily context, news risk, and your own performance. The real edge comes from combining a few tools with disciplined execution and solid risk management.

Next step (simple 2-week challenge): pick one setup:

- Intraday: Session High Low (3.2) + Daily Data (3.7)

- Levels: Key PA Levels (3.1) + S/R Price Zones (3.3)

- Discipline: Strategy Checklist (3.9) + Daily Profit Loss (3.6)

CTA: If you found this helpful, leave a comment with your trading style (intraday/swing/EA) and I’ll suggest the cleanest 2–3 indicator combo for your approach.

The most important indicators you have not put on. Pivot points in multiple time frames. The only leading indicator !

Hi How do I format the text files in link to the appropriate .ex4 format ? thanks

Hello Garry,

The ones that download as text files, you can right click with your mouse and choose “Save as…”

On the download window edit the name of the file to remove the “.txt”.

For example the file named “Key-PA-Levels.mq4.txt” you should save it as “Key-PA-Levels.mq4”

MT4 recognizes the mq4 files without problem